Exactly How To Find The Best Lenders For Bad Debt Loans

Article by-Gregory MonradThere are numerous alternatives for poor credit loans. You ought to take the time to compare prices and charges, as well as loan total up to locate the most effective one. It is additionally vital to recognize the settlement terms and also whether or not they match your budget. It is important to know your repayment options prior to you request a loan, as your situation might transform if you don't make your settlements. Listed below are a few of the most effective lending institutions for poor debt lendings.

On-line lending institutions: These are primarily financial institutions, however without the physical areas. On-line loan providers choose promptly and also deposit funds in your savings account within a few organization days or hours. Several do not bill application costs, early repayment charges, or other covert charges. If you get approved for a negative credit finance, these alternatives can be an excellent choice for you. These financings can aid you pay off your costs and obtain the added cash money you need to keep your monetary situation afloat.

Bad credit rating financings are a terrific short-term monetary service for consumers with bad or no debt. Although they bring a high interest rate, these car loans are usually a wonderful means to come back on track. In addition to helping you spend for a few extra weeks or months, they can also help boost your credit scores score, making you a much more attractive borrowing possibility in the future. Nevertheless, these car loans should just be made use of as a temporary option.

Be wary of scammers when trying to find negative credit financings. Those that do not do a background check are typically looking for individual info. The genuine loan providers will only call you directly, and will not request for your checking account information or individual info prior to depositing the funds in your account. Furthermore, they will commonly guarantee that you will be approved. If you discover a lender who guarantees you approval, be cautious due to the fact that they will not be straightforward and unclear concerning their prices or providing terms.

The amount you can obtain will rely on your monetary situation, your credit rating, and your lending institution. Lower credit report might be qualified for smaller sized financings. The complete cost of your loan will certainly be established by how much you obtain, how much time you repay it, and also just how much rate of interest you'll pay on it. Your settlement alternatives should be based upon these aspects, along with the interest rate, or APR, of your finance. Generally talking, bad debt loans have greater APRs than standard car loans.

https://loans.usnews.com/medical-loans can be an excellent choice for individuals with low credit history. Not just can they assist you reconstruct your credit score, but they can additionally instruct you just how to invest your money sensibly. Make sure you pay your bills in a timely manner, and also you'll soon be on your method to having a better monetary future. And don't fail to remember that you can get a negative credit financing online. It's less complicated than you think! If you need an individual finance, you can look into these lenders and pick the most effective option for your scenario.

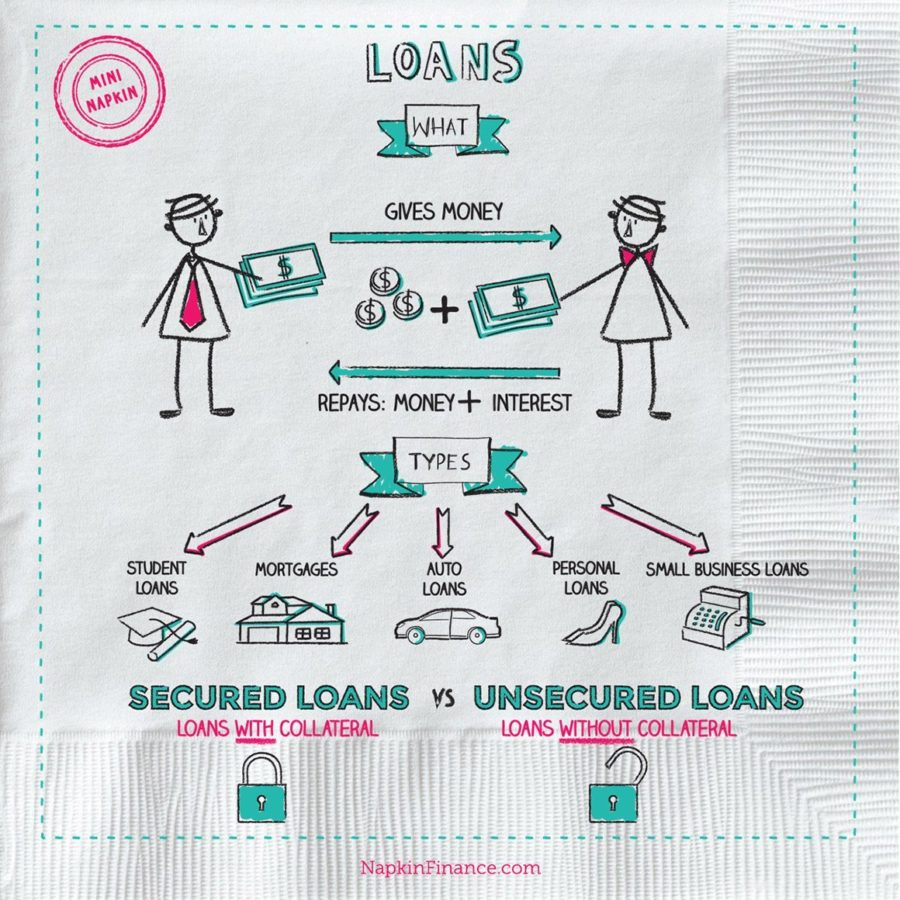

As soon as you've gotten a checklist of lending institutions, you'll wish to apply. There are several online negative debt loan providers that concentrate on this sort of funding. You can also look for neighborhood credit unions and loan providers in your area. These will have the ability to offer personal financings if they accept debtors with poor credit scores. Negative debt finances can be secured lendings or unsecured ones. It is necessary to compare the rate of interest and also charges of each alternative prior to applying.

On-line personal loan suppliers have become an excellent option for individuals with negative credit history. Unlike various other kinds of loan providers, online loan providers aren't bound by the BBB's certification. Yet, they can supply low rates and versatile repayment terms. If you're seeking an on-line personal financing service provider, think about Funds Happiness. Although that this website doesn't have a BBB certification, their loans are reasonable and also come with budget friendly APRs as well as payment terms.

An additional choice is a household financing. Read the Full Guide are most likely to approve the risk of back-pedaling payment than a company entity. However, do not be reluctant about asking a relative for financial backing. It can cause strained connections. Make certain to have a written agreement that clearly describes the regards to the lending, rate of interest, and also repayment choices. There are additionally various other alternatives besides family members finances, such as credit cards.